A common refrain that we hear from businesses is that they are very interested in reducing their energy costs, but they just don’t have money in the budget to pursue projects that save energy. They recognize how great an investment energy saving projects can be, yet capital expenditures are allocated instead to projects that increase production. Any money in the budget for the actual facility goes to keeping it running and ongoing maintenance problems. At SEMCO we understand that budgets can be tight and how it may seem like there’s not enough money available to pursue projects that save energy. However, the truth is we have never found a business that does not have the money to pay for an energy saving project. Because believe it or not, they are already paying for it.

You may be thinking how can a business already be paying for a project that they have not decided to pursue? The reason is that there is a real cost for not doing projects that save energy. This real cost is for the excess energy that would not have to be paid for if the business went ahead with the project. We call this the ‘cost of waiting’, and while it may seem insignificant because you don’t see it clearly listed as a line item on your electricity bill, it is a REAL cost that can add up quickly. Take the following example….

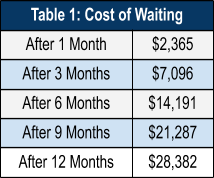

Alabama Building Supplies Inc. (ABS Inc.) is thinking about upgrading the lighting in its warehouse from metal halide lighting to LED lighting. The total cost of the project is $45,000 but the annual energy savings are $28,382. While they recognize that the energy savings are substantial, ABS Inc. believes they do not have the funds available in their budget to proceed with the LED upgrade. So the question is, does ABS Inc. find a way to do the project now or wait until next year when there may be funds available in the budget to proceed with the project. Thinking they are making a sound financial decision, they decide to wait without realizing the ‘cost of waiting’ that they are incurring each month for not doing the project (see Table 1: Cost of Waiting).

From the table, it is easy to see that ABS Inc. is paying $2,365 a month for not proceeding with the project. This monthly payment could be going towards an improved lighting system for their warehouse, but is instead going directly to their utility company. ABS Inc. is essentially investing in their utility, not their facility.

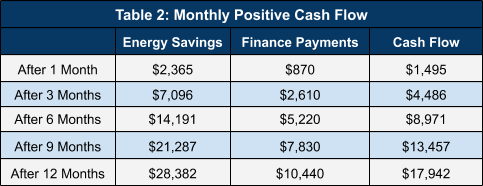

By considering the ‘cost of waiting’, it’s clear that companies are already paying for energy saving projects even if they choose not to proceed with them. But that still leaves us with the question, what if a company does not actually have the funds available in their budget to pay for the project? There are several low financing or leasing options available so that there’s no need to wait for funds to become available. So instead of paying a monthly ‘cost of waiting’ payment to the utility, the monthly payment is redirected to paying for the cost of the project. Even better, a financing or leasing option oftentimes provides immediate positive cash flow for the company. Consider our previous example with ABS Inc. If they had decided to finance the project, the energy savings from the LED lighting upgrade would be more than their monthly finance payment (see Table 2: Monthly Positive Cash Flow).

As you can see, there’s no reason to wait to proceed with an energy saving project. By waiting, you are already paying for the project, investing in your utility company, and missing out on positive cash flow.

If your company is interested in evaluating energy saving projects, please reach out to us today to schedule your free consultation.