The industrial and manufacturing industry, which accounts for 32% of the United States energy usage, represents one of the single largest energy cost reduction opportunities in the US, with a chance to cost-effectively eliminate 15% – 32% of its energy usage by 2025.

Doing so will take place with the adoption of technologies like LED lighting, cloud-based connected controls (industrial internet), advanced electric motors and drives, high-efficiency boilers, modernization and replacement of antiquated process equipment and more.

And while savings opportunities are clearly present, the primary barrier for manufacturing executives to overcome is carving out the needed capital expenditure dollars to pay for the upgrades.

Which leads us to today’s post….

Using Your Energy Budget to Pay for Energy Savings Projects

A long-standing issue for energy efficiency adoption in any industry is the internal competition for capital. In every business, there is a finite capital expenditure budget that needs to be allocated appropriately across the business to grow and increase value for shareholders.

However, unlike many capital projects that are competing for resources, most executives don’t realize they are already paying for energy efficiency improvements in an existing monthly budget by overpaying their power company.

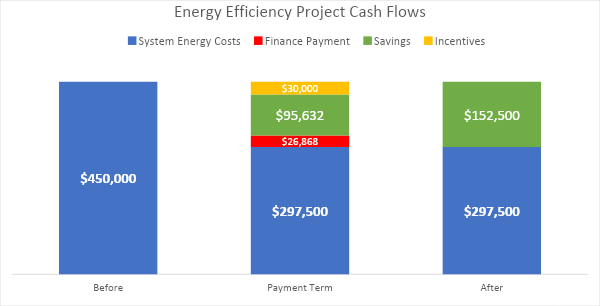

Below is a graphical example.

Left Bar (Before)

Every year your CFO budgets a set amount of capital for electricity, a portion of which is seen in the below left blue bar.

Middle Bar (Payment Term)

By partnering with an energy efficiency contractor like SEMCO and implementing projects like LED lighting, compressed air controls, and variable frequency drives, it’s determined that energy costs in these categories can be lowered by a guaranteed combined 34%.

Instead of paying for these projects with scarce capital resources or worse, delaying the projects and associated savings altogether, the best approach would be to implement the energy efficiency projects, finance them with low-interest capital over a set period, take advantage of the available grant, rebate, and tax incentives, and pocket the free cash flow as savings over the finance term. Or even better, use the savings to increase your capex budget for other needed capital improvement requests over the finance term.

Right Bar (After)

Once the payment term is complete, your facility is now using 34% less energy than its competitors, and it didn’t cost you a dime in capital expenditure dollars.

As you can see, the needed efficiency improvements were already being paid for in the existing budget. By postponing the proposed upgrades, the facility would have missed out on new equipment, incentives for upgrading the plant and immediate positive cash flow.

If your facility is interested in evaluating energy-saving improvements and taking advantage of little known incentives to help pay for them, reach out and contact us for your free initial assessment.

References: https://www.energy.gov/sites/prod/files/2015/06/f23/EXEC-2014-005846_6%20Report_signed_0.pdf